1. What is Amherst's financial status now that the November levy failed?

On October 23, 2025, the Ohio Department of Education & Workforce (ODEW) reviewed the district's October Forecast and identified a deficit of -$7,448,352 in fiscal year 2028 (FY28). In accordance with Ohio Revised Code 5705.391, ODEW notified the district that it considers Amherst to be in a “precautionary” financial status. In accordance with Ohio Administrative Code 3301-92-04, ODEW requires Amherst to submit a Board of Education approved written plan to eliminate the FY28 deficit.

The written plan must be approved by the Board of Education and submitted to the ODEW Office of Budget and School Funding by December 21, 2025. The Amherst Board of Education must approve a written plan at the regular scheduled Board Meeting on December 15, 2025 to meet the state's deadline.

2. What is the process moving forward to reduce expenditures?

Amherst's October Forecast was approved by the Board on October 6, 2025 with a deficit of -$7,448,352 in FY28. On October 7, 2025, the Lorain County Commissioners approved a measure to increase the homestead & owner-occupied property tax exemption, thereby reducing our local funding by over $840,000. As a result, the updated forecast now shows a deficit of -$8,542,101 in FY28.

The Amherst Board of Education must approve and submit a written plan to ODEW by December 21, 2025 to eliminate the FY28 deficit. The recommendation from our fiscal consultant at the Office of Budget and School Funding is to eliminate $4-5 million in FY27 and $4-5 million in FY28. Therefore, the district will need to make approximately $5 million in permanent cuts for next school year that will continue throughout the future years of the financial forecast.

Once the plan is reviewed and approved by ODEW's Office of Budget and School Funding, the plan will be implemented between January 2026 and August 2026 before the start of the 2026-2027 school year.

3. What cuts will occur now that the November levy failed?

Approximately 82% of Amherst's operating expenditures are used to fund teacher and staff salaries and benefits, so approximately 80% of the cuts will involve staffing. With no new revenue, the district will need to reduce staffing by 30-40 positions including administrators, teachers, instructional coaches, social workers, classroom aides, monitors, maintenance staff/custodians, bus drivers, and support staff. The district needs approximately $4 million in staffing reductions for next year. The cuts are required to be permanent and continue throughout the four-year forecast. The cuts will be reviewed and approved by the Ohio Department of Education & Workforce.

Approximately 18% of Amherst's operating expenditures are used to fund essential classroom needs such as supplies, resources, curriculum, textbooks, and technology, so approximately 20% of the cuts will involve operational expenditures. The district needs approximately $1.5 million in supplies, resources, supplemental programs, technology, and curriculum reductions for next year. The cuts are required to be permanent and continue throughout the four-year forecast. The cuts will be reviewed and approved by the Ohio Department of Education & Workforce.

4. Why does the district need new revenue?

Ohio school funding is primarily focused on local property tax levies where the revenue is generally frozen due to HB 920. As a result, Ohio school districts must place local property taxes on the ballot every few years, build a positive cash balance until deficit spending occurs, and then ask for new revenue through a new tax.

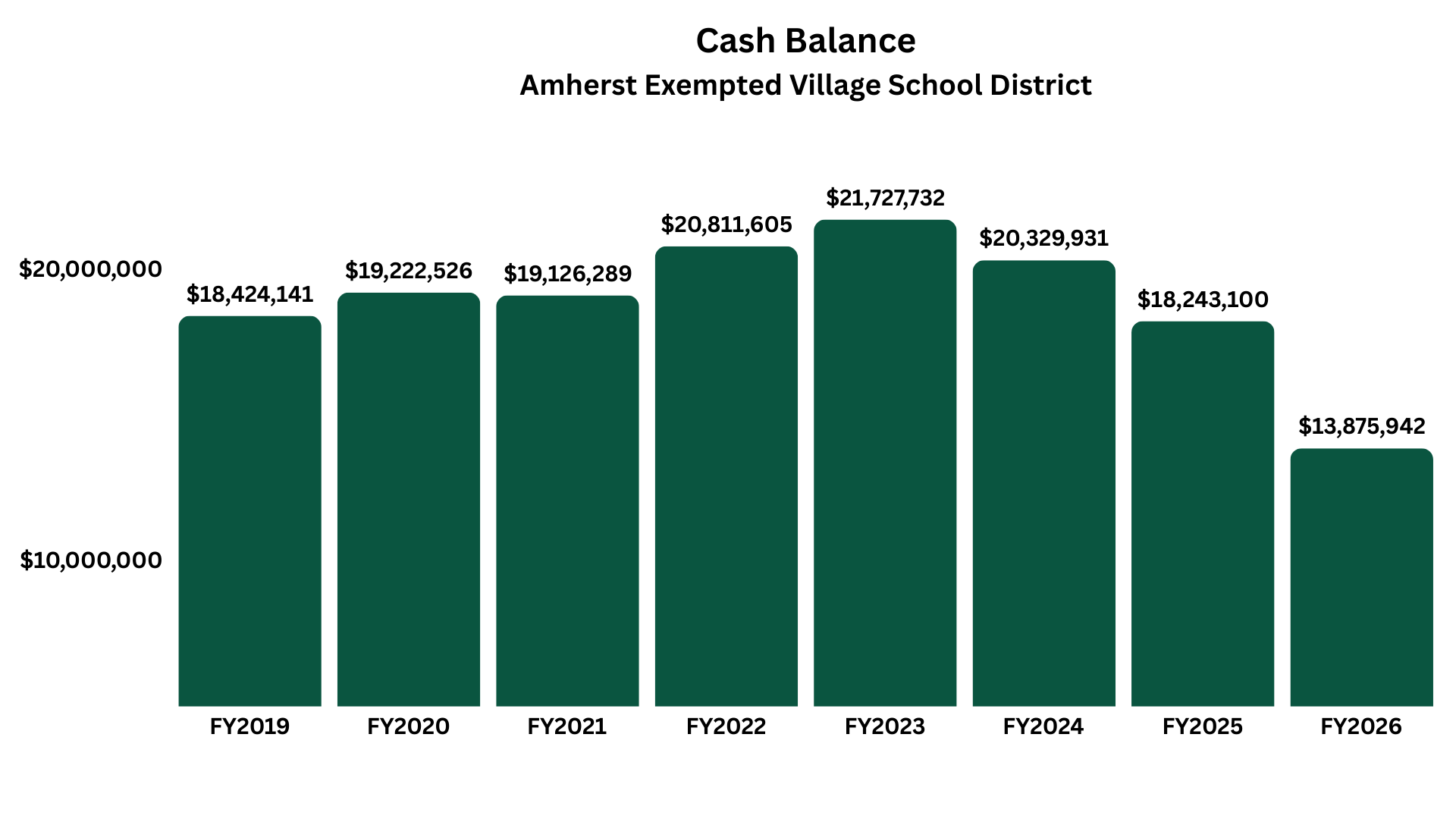

The Amherst Exempted Village School District asked for new operating money in 2012, built up a cash reserve, and is now deficit spending. In FY2022, the district had an ending cash balance of $21,727,732. In FY2023, the district deficit spent -$1,397,801 with an ending cash balance of $20,329,931. In FY2024, the district deficit spent -$2,086,831 with an ending cash balance of $18,243,100. In FY2025, the district deficit spent -$4,367,161 with an ending cash balance of $13,875,942. The deficit spending is projected to be over $6 million in FY2026 and $7-8 million in FY2027.

Unfortunately, this is the system that Ohio uses to fund schools. The state pushes the burden onto local school districts and communities instead of funding schools appropriately. With no additional revenue from the state or from local taxes, the Amherst Schools will continue its deficit spending and will move into Fiscal Watch or Fiscal Emergency.

5. When did the Amherst Schools last pass a new operating levy?

Despite rising costs each year, the last time our district passed new operating funds was in 2012. The district has lived within that revenue stream for 13 years by stretching every dollar, finding efficiencies, and making strategic investments in our students. And without new operating revenue since 2012, we’ve still added school counselors, social workers, deans of students, instructional coaches and implemented innovative programs such as K–8 Wellness, Robotics and Advanced Manufacturing, the Navy National Defense Cadet Corps, and a new Business & Entrepreneurship program at Marion L. Steele High School.

6. Why do schools ask for levies every 4-6 years?

While this cycle is typical every 4–6 years in most school districts, Amherst has not asked for new operating funds in 13 years. Most school districts need new operating levies every 4–6 years because of Ohio’s school funding laws. Property tax revenue, which makes up the largest share of school funding, is frozen at the amount approved by voters under House Bill 920 (1976). This means that even when property values rise, schools receive minimal additional revenue. At the same time, the cost of salaries, benefits, utilities, supplies, technology, and curriculum continue to increase each year. As a result, expenses eventually outgrow revenue, and districts must return to voters to ask for new operating funds.

7. Isn't the school district getting huge increases from last year's property reappraisals?

Property tax revenue, which makes up the largest share of school funding, is frozen at the amount approved by voters under House Bill 920 (1976). While most of the property tax revenue is frozen from growth, the school district does receive increases in property tax revenue from "inside millage". The Amherst Schools had 5.2 inside mills during reappraisal and the Lorain County Auditor's Office projected an "inside millage" revenue increase of approximately $1.2 million.

While the Amherst School District was hoping to reap the benefit of inside millage, two major events just erased that increase. First, Ohio is reducing our state funding by a projected $600,000-$800,000 this school year (July 1 - Governor's Budget). Second, the Lorain County Commissioners approved a measure to increase the homestead & owner-occupied property tax exemption, thereby reducing our local funding by over $840,000 (October 7).

The combined loss of state funding and county exemptions are projected to cut Amherst's funding by over $1.4 million per year!

8. How is the Amherst Exempted Village School District financed?

The majority of Amherst’s funding comes from local revenue. Amherst receives 43% of its funding from local taxes. Amherst receives an additional 39% of its funding from the State of Ohio, 11% from the federal government, and 7% from other revenue.

9. Is the State of Ohio providing enough revenue and support for Amherst?

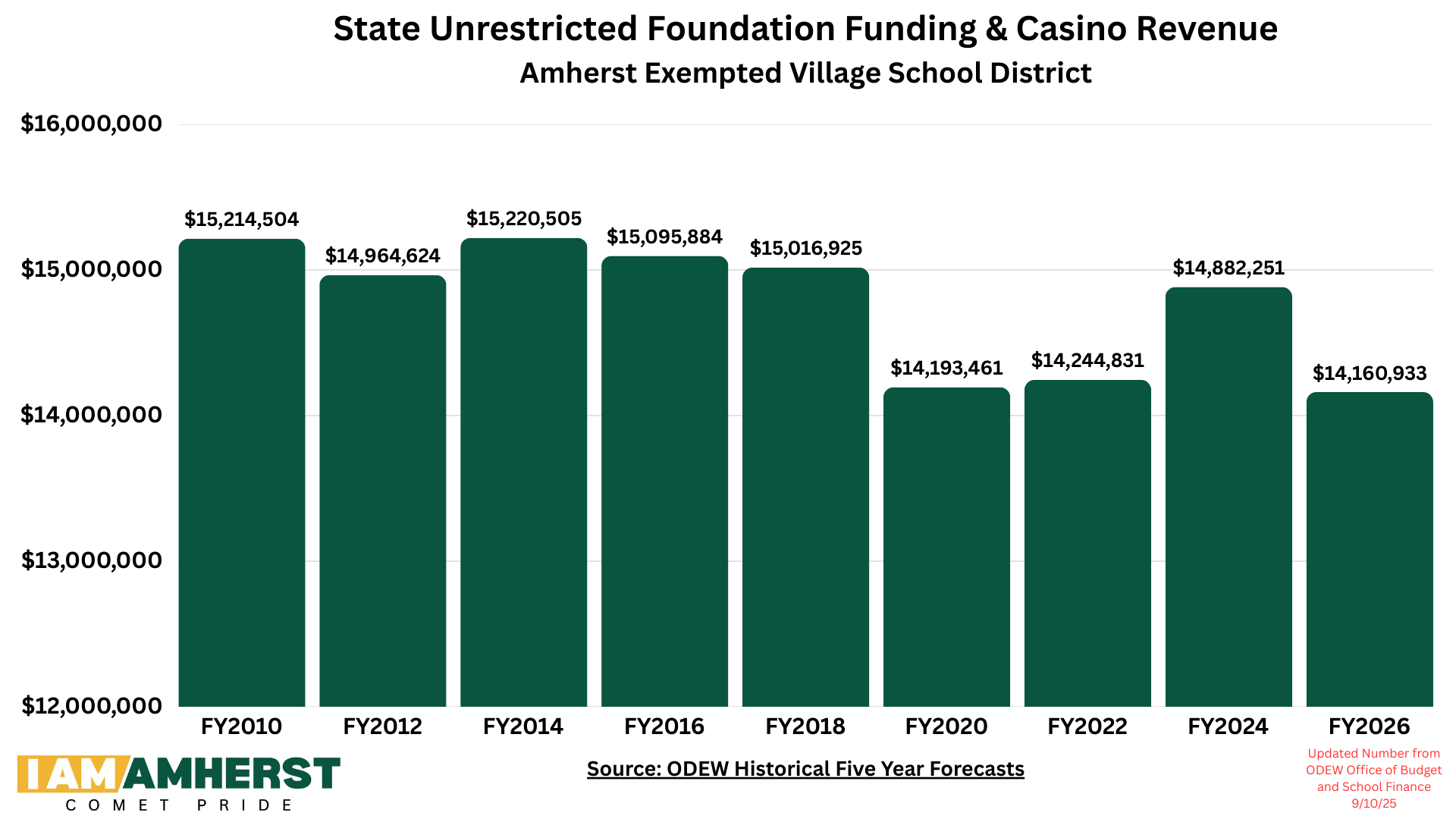

No. In FY2025, Amherst received $14,755,730 in state unrestricted foundation funding plus casino revenue from the State of Ohio to help fund our school district. In FY2026, Amherst is projected to only receive $14,160,933 in state unrestricted and casino funding - a reduction of about $600,000 dollars in one year. To provide context, in 2010, Amherst received $15,214,504 in state foundation funding. For the last 15 years, the State of Ohio’s foundation funding for the Amherst Exempted Village School District has steadily declined. Please see the graph below for more details.

10. How does Amherst compare to other school districts in regards to revenue?

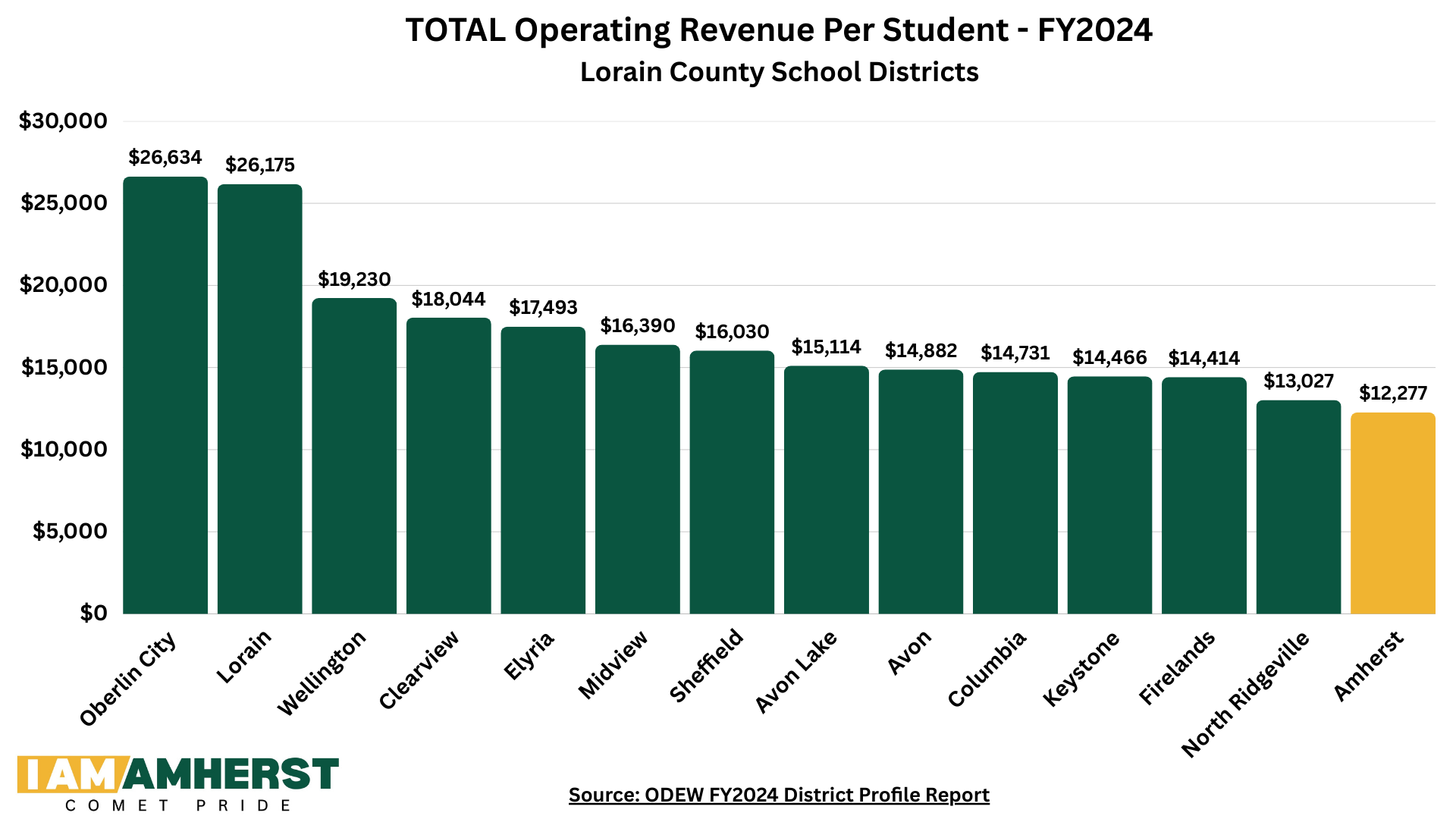

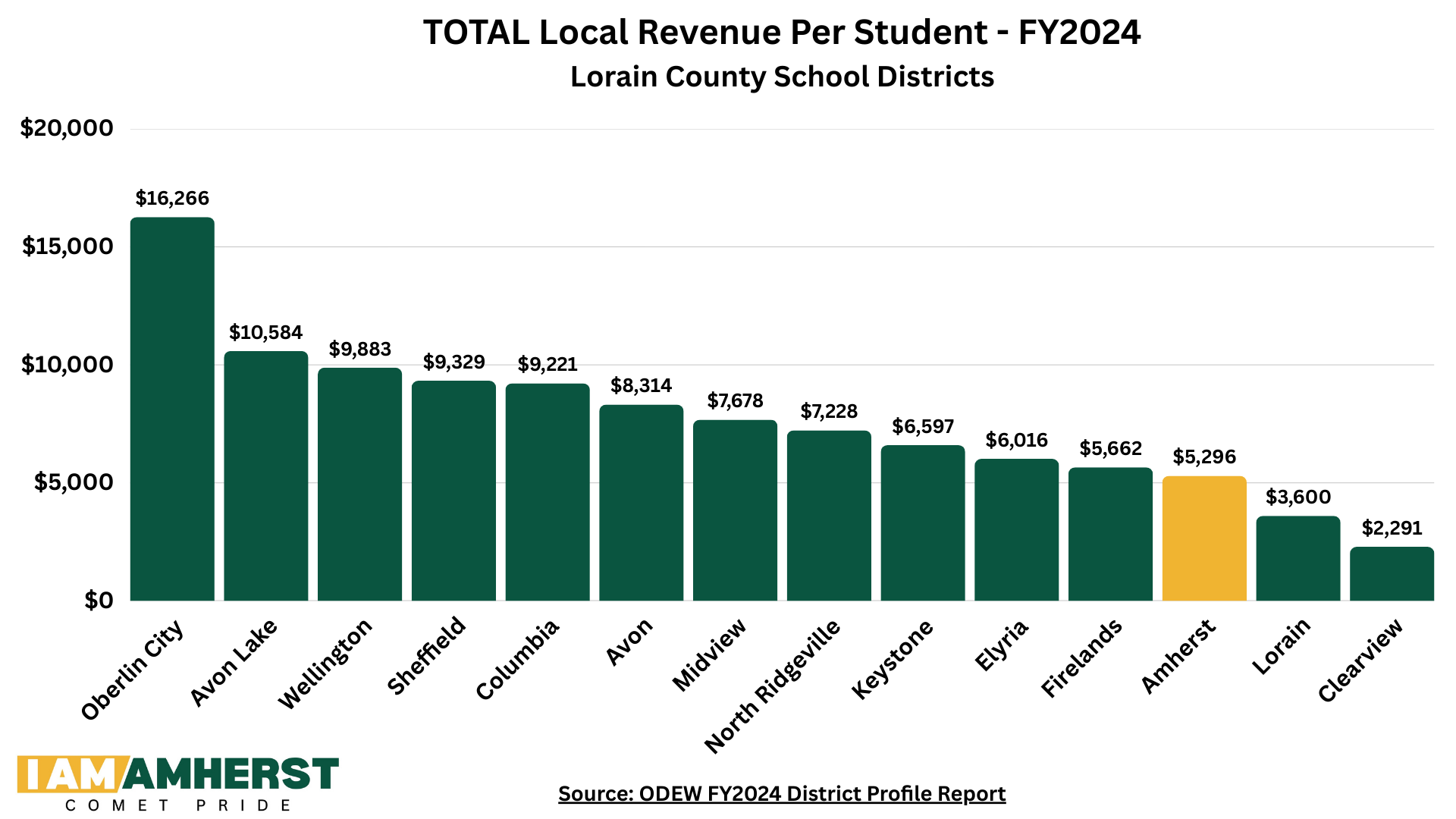

In 2024, Amherst received $5,296 per student from local revenue and $4,754 per student from state revenue. Amherst received $12,277 per student in total revenue which is the lowest amount in Lorain County and the second lowest amount in the State of Ohio. Out of 606 school districts in Ohio, the Amherst Exempted Village School District ranks 605th in total revenue per student. For comparison, Amherst received $12,227 per student, the state average was $18,168 per student, and the Ohio school district with the highest revenue received $44,246 per student. Please see the graphs below for more details.

11. How does Amherst compare to other school districts in regards to expenditures?

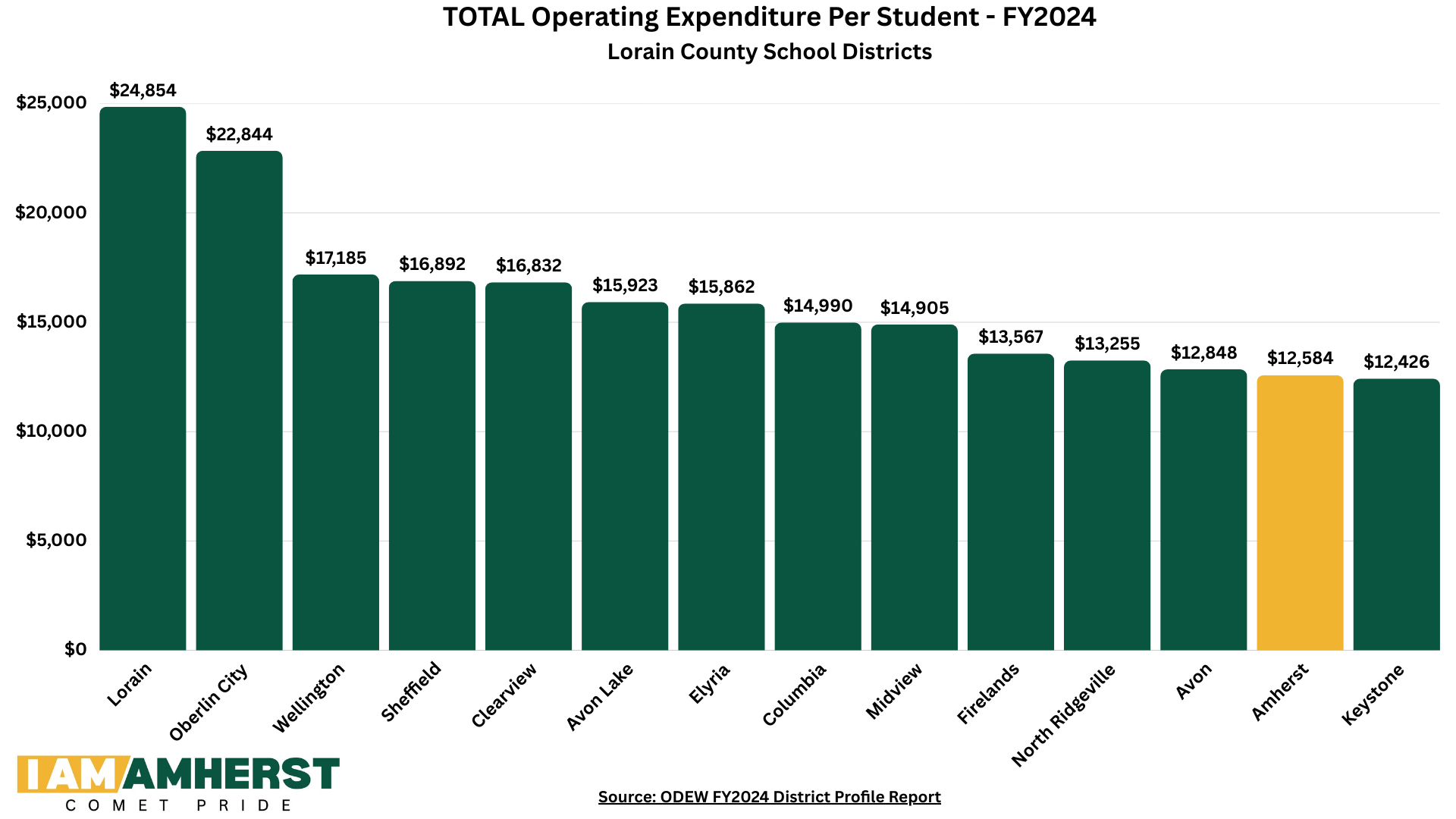

In 2024, Amherst spent $12,548 per student in total expenditures which is the second lowest amount in Lorain County. Out of 606 school districts in Ohio, the Amherst Exempted Village School District ranks 570th in total expenditures per student. For comparison, Amherst spent $12,548 per student, the state average was $16,311 per student, and the Ohio school district with the highest expenditures spent $37,449 per student. Please see the graph below for more details.

12. Does the district ever seek additional revenue to offset expenditures?

Yes. Over the last three years, the district has used almost $4 million in COVID relief grants to offset costs in personnel, supplies, technology, and purchased services. Amherst was the only school district in the state of Ohio to receive both the Comprehensive Literacy State Development grant worth $270,000 and the Each Child Reads grant worth $67,233 in the last three years. Amherst also received a competitive $1.6 million Ohio Career Technical Equipment grant to fund our state-of-the-art Robotics and Advanced Manufacturing program at Marion L. Steele High School. In addition to competitive grants, the Amherst Exempted Village School District also works with business partners, community partners, and private citizens to help fund special projects and initiatives through public and private donations. Recently, the Amherst Schools have received a $160,000 private donation to support the track renovation, $40,000 from the Amherst Schools Educational Foundation (ASEF) to create a new Comet Corner store, $25,000 from ASEF to fund a new Business & Entrepreneurship teacher, and recently signed a ten-year agreement with Spitzer Autoworld Amherst worth $25,000 per year for stadium naming rights (Spitzer Stadium). The Amherst Schools work very hard to find alternate revenue streams to offset costs!

13. Will new homes and previous communities with ending tax abatements provide more revenue in the future?

Yes. It is very difficult to predict the revenue from new homes but a new $250,000 home would generate about $2,000 of new tax revenue to the school district. Each new home can also bring new Amherst students which adds to our expenditures. As for homes with tax abatements, the City of Lorain has provided us a list of abated homes and their abatement schedule. Over the course of the next five years, we’ve identified 89 homes which will start providing school revenue. The total revenue from those 89 homes is about $81,000 per year once all 89 homes are in full collection by FY 2030.

14. How does Amherst compare to other Ohio school districts in academics?

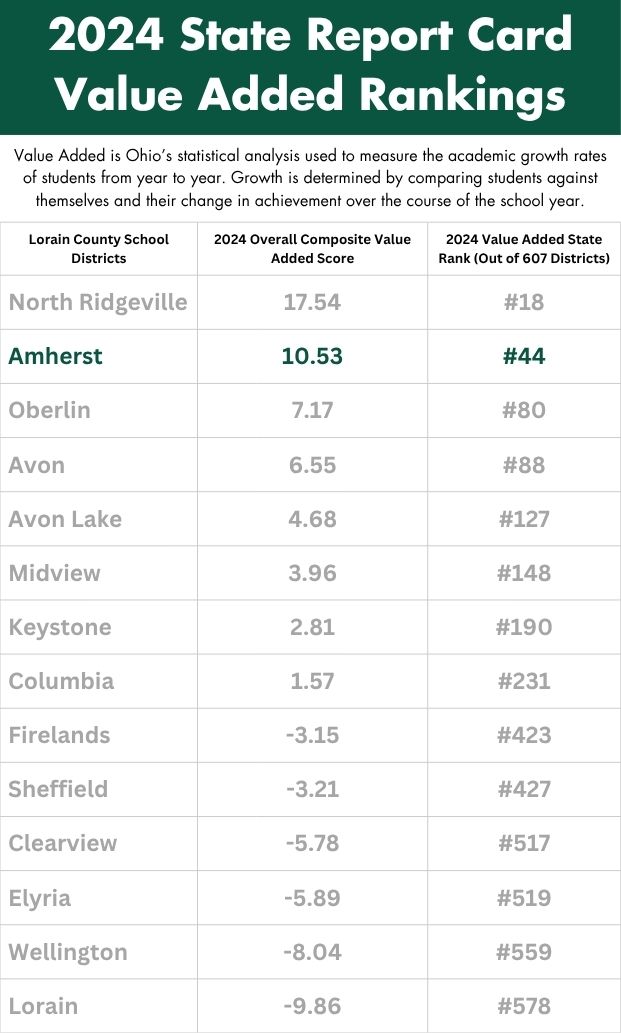

On last year's State Report Card, Amherst was in the top 8% of school districts on the state's Value Added measure of the report card. Value Added is Ohio’s statistical analysis used to measure the academic growth rates of students from year to year. Growth is determined by comparing students against themselves and their change in achievement over the course of the school year. Please see the comparison below to the rest of Lorain County.